What Does Paul B Insurance Medicare Agency Melville Do?

Table of Contents8 Easy Facts About Paul B Insurance Medicare Agency Melville DescribedThe smart Trick of Paul B Insurance Insurance Agent For Medicare Melville That Nobody is DiscussingPaul B Insurance Medicare Agent Melville Things To Know Before You BuyThe Only Guide to Paul B Insurance Medicare Agent MelvillePaul B Insurance Medicare Agency Melville for BeginnersHow Paul B Insurance Medicare Agency Melville can Save You Time, Stress, and Money.

This analysis concentrates on 1,605 respondents age 65 and also older who were signed up in Medicare. To find out more regarding our study, including the revised sampling approach, see "Just how We Performed This Survey.".Before submitting any insurance claims for treatment associated to a sensitive diagnosis, we informed Professionals of this adjustment by sending an one-time notification to all Veterans who had actually authorized a release of details refusing to enable us to costs for care pertaining to a delicate diagnosis in the past. The Federal Register also published this adjustment.

We're called for by law to bill your medical insurance (including your partner's insurance policy if you're covered under the plan). The money collected returns to VA clinical facilities to support health and wellness treatment sets you back given to all Veterans. You can submit a constraint request asking us not to disclose your health info for invoicing objectives, yet we're not required to approve your demand.

All About Paul B Insurance Medicare Insurance Program Melville

You can also ask to chat with the billing workplace to learn more (paul b insurance insurance agent for medicare melville).

, which covers all copays and also deductibles. If you were qualified for Medicare prior to that time yet haven't yet registered, you still may be able to obtain Strategy F or Strategy C.

How Paul B Insurance Medicare Agent Melville can Save You Time, Stress, and Money.

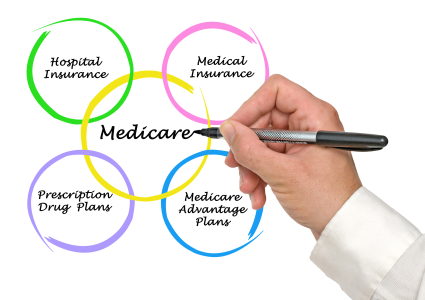

If you do not buy it when you first end up being qualified for itand are not covered by a medication plan via job or a spouseyou will certainly be billed a life time penalty if you shop it later. A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare.

Medicare Advantage Plans do have an annual limit on your out-of-pocket costs for medical solutions, called the optimum out-of-pocket (MOOP). As soon as you reach this limitation, you'll pay nothing for covered solutions. Each plan can have a different limit, and the restriction can change every year, to ensure that's an element to think about when purchasing one.

Out-of-pocket expenses can quickly develop throughout the years if you get ill. The Medicare Advantage Plan might you can check here provide a $0 costs, but the out-of-pocket shocks may not deserve those initial cost savings if you obtain ill. "The best candidate for Medicare Benefit is someone that's healthy," claims Mary Ashkar, senior lawyer for the Facility for Medicare Advocacy.

The Main Principles Of Paul B Insurance Medicare Advantage Agent Melville

This implies that when you sign up later in life, you will pay even more per month than if you had begun with the Medigap plan at age 65. You might be able to find a policy that has no age rating, however those are rare.

Medicare recipients pay nothing for most precautionary solutions if the services are obtained from a medical professional or other health and wellness care company who participates with Medicare (also recognized as approving job). For some preventive services, the Medicare beneficiary pays absolutely nothing for the solution, yet might need to pay national health insurance coinsurance for the office browse through to obtain these solutions.

Some Known Details About Paul B Insurance Insurance Agent For Medicare Melville

https://g.page/paulbinsuranceservices?share

On or after January 1, 2020, insurance firms are called for to provide either Plan D or G in addition to An and B. The MACRA adjustments additionally produced a brand-new high-deductible Plan G that may be offered beginning January 1, 2020. To learn more on Medicare supplement insurance strategy design/benefits, please see the Advantage Chart of Medicare Supplement Program.

Insurance firms might not refute the candidate a Medigap policy or make any kind of costs price distinctions since of health standing, declares experience, medical condition or whether the applicant is receiving healthcare solutions. Qualification for policies offered on a team basis is limited to those individuals that are participants of the team to which the policy is provided.

Not known Facts About Paul B Insurance Medicare Advantage Plans Melville

Medicare Select is a kind of Medigap policy that needs insureds to make use of certain healthcare facilities and also sometimes details medical professionals (except in an emergency situation) in order to be eligible for full benefits - paul b insurance medicare health advantage melville. Other than the constraint on hospitals as well as providers, Medicare Select policies should satisfy all the needs that put on a Medigap policy.

When you use the Medicare Select network healthcare facilities and also carriers, Medicare pays its share of accepted costs and the insurance company is accountable for all extra benefits in the Medicare Select policy. As a whole, Medicare Select policies are not needed to pay any type of benefits if you do not use a network company for non-emergency services.